The article below is sourced from Bloomberg Wire Service. The views and opinions expressed in this story are those of the Bloomberg Wire Service and do not necessarily reflect the official policy or position of NADA.

Nissan Motor Co. said full-year operating profit came in at ¥530 billion ($3.4 billion) — 15% lower than it forecast as recently as February as sales fell short of expectations.

Sales were 3.44 million units, less than the 3.55 million forecast given Feb. 8, the automaker said Friday. That compares with around 5 million as little as five years ago, with an aging lineup, lack of hybrid options in North America and intensifying competition in China contributing to the decline.

An earthquake in Japan earlier this year and other logistics issues also affected sales, according to the company. Net income in the 12 months ended March 31 was ¥370 billion, compared with February’s forecast of ¥390 billion.

“The US has a big impact and the hybrid mix is growing more than what we anticipated,” Chief Executive Officer Makoto Uchida said during a virtual press conference. Nissan is also bearing the cost of investments that suppliers made based on previous sales targets, as well as providing relief to them from increasing inflation, he said.

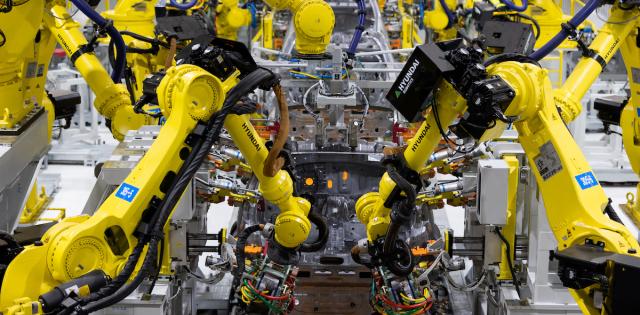

Last month, Nissan unveiled plans to sell an additional 1 million vehicles a year by 2027 by introducing dozens of new models — including more cost-effective EVs. It also announced a partnership with Honda Motor Co. to develop EV technology. The rivals, which initially signed a memorandum of understanding, said they will collaborate on core technology for battery-based electric vehicles, including software.

But Friday’s release may cast doubt on Nissan’s ability to achieve the goals set out in the plan it announced in March.

The factors of lower sales volume and various cost-relief measures have been known for some time, and “it’s unclear if they were factored into Nissan’s mid-term plan,” Bloomberg Intelligence senior analyst Tatsuo Yoshida wrote in a note. “It could undermine the viability of its targets.”

On the topic of the weakening yen, which is trading near a 34-year low, Nissan’s Chief Financial Officer Stephen Ma said the foreign-exchange impact is “positive” and the company will give a detailed analysis during its earnings announcement, which is likely to come next month. For now, the company has no plans to change its dividend policy, he said.

For more stories like this, bookmark www.NADAheadlines.org as a favorite in the browser of your choice and subscribe to our newsletter here: