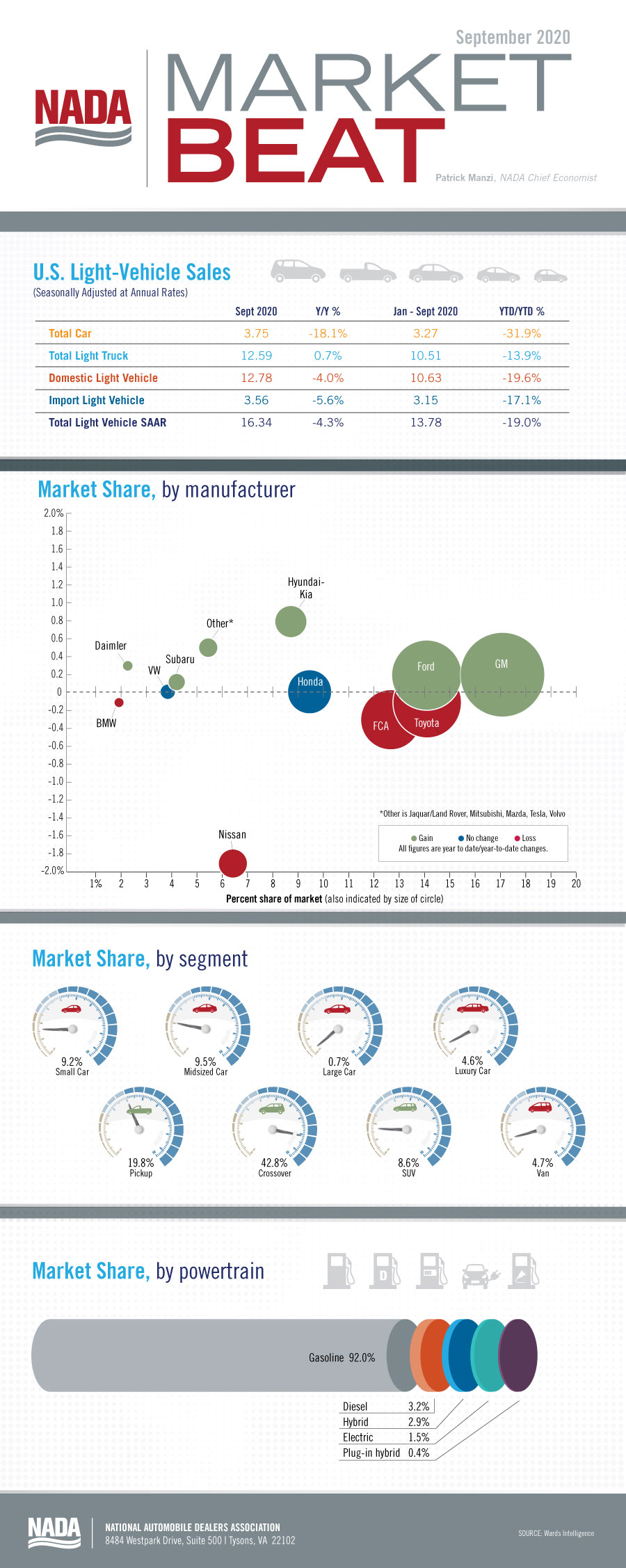

The year came to close with new light-vehicle sales of 14.46 million units, down 14.7% from 2019 and the lowest full-year sales total since 2012. It was also the first time since 2014 that sales did not top 17 million units. December 2020’s SAAR of 16.3 million, while down from December 2019’s SAAR of 16.8 million units, was better than expected and helped finish out the year on a positive note.

Through most of 2020, retail sales outperformed fleet sales, as several major rental car agencies canceled a large portion of their fleet orders early in the pandemic. Retail sales in December 2020 should increase 0.5% from December 2019, while fleet volume is expected to be down by 33%. Fleet demand is the main factor preventing total light-vehicle sales volume from returning to pre-COVID levels. According to Wards Intelligence, estimated total retail sales volume in 2020 dropped 9.3% and accounted for 85.7% of light-vehicle sales, compared with 80.4% in 2019. Estimated fleet volume fell 38% and represented 14.3% of total sales, versus 19.6% of total sales in 2019. We expect that fleet demand will continue to increase throughout 2021 as more Americans get vaccinated and can return to their daily lives.

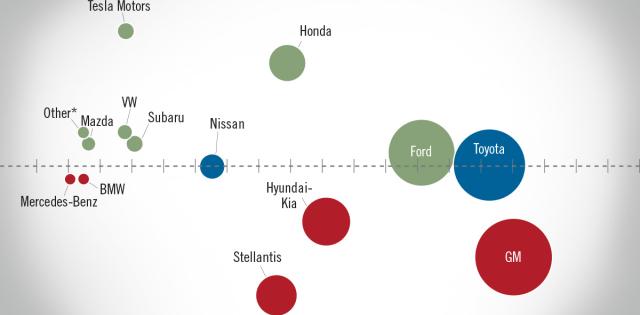

Following auto-manufacturing plant closures last spring and strong retail demand since, automakers entered December with inventory levels down 22% year over year. Tight inventory, especially in the red-hot pickup segment, may have limited the number of retail sales in December. But because of the tight inventory and strong demand, dealers and manufacturers relied less on incentives. According to a preliminary estimate from J.D. Power, average incentive spending per unit was $4,014, down 12.7% year over year. Consumer preferences for full-size pickups and other more expensive vehicles, coupled with lower discounting, pushed up average transaction prices to an all-time high of $38,077 in December 2020, says J.D. Power. This average transaction price represents an increase of 9% from December 2019. Pickups represented just under 20% of all new light vehicles sold—their highest market share in decades—and the broader light-truck segment represented 76.4% of all sales.

For 2021, we are optimistic about the continued recovery of the new light-vehicle market. The recently passed stimulus package may also provide a small boost to new-vehicle sales, and a wave of pent-up demand could well be unleashed in the summer and fall months once most Americans have been vaccinated. Still, COVID-19 outbreaks may cause labor shortages or supply chain disruptions that could impact inventory levels on dealer lots, and a global shortage of semi-conductor microchips used in nearly all facets of auto production could cause some manufacturers to underproduce. For 2021, we expect new light-vehicle sales to total 15.5 million units.